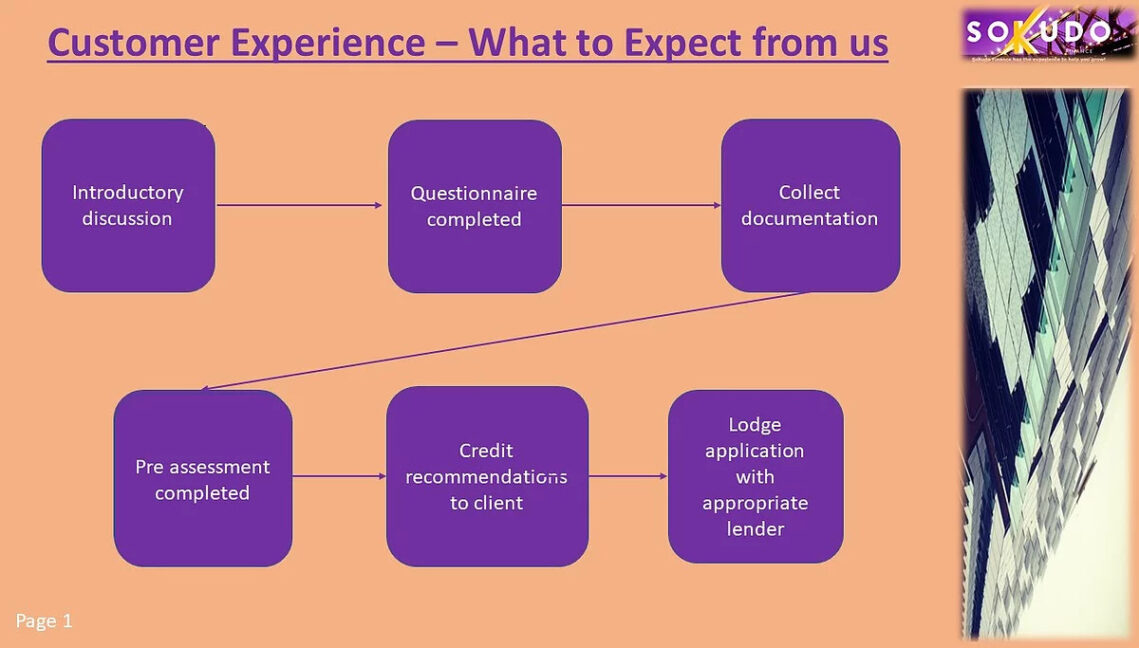

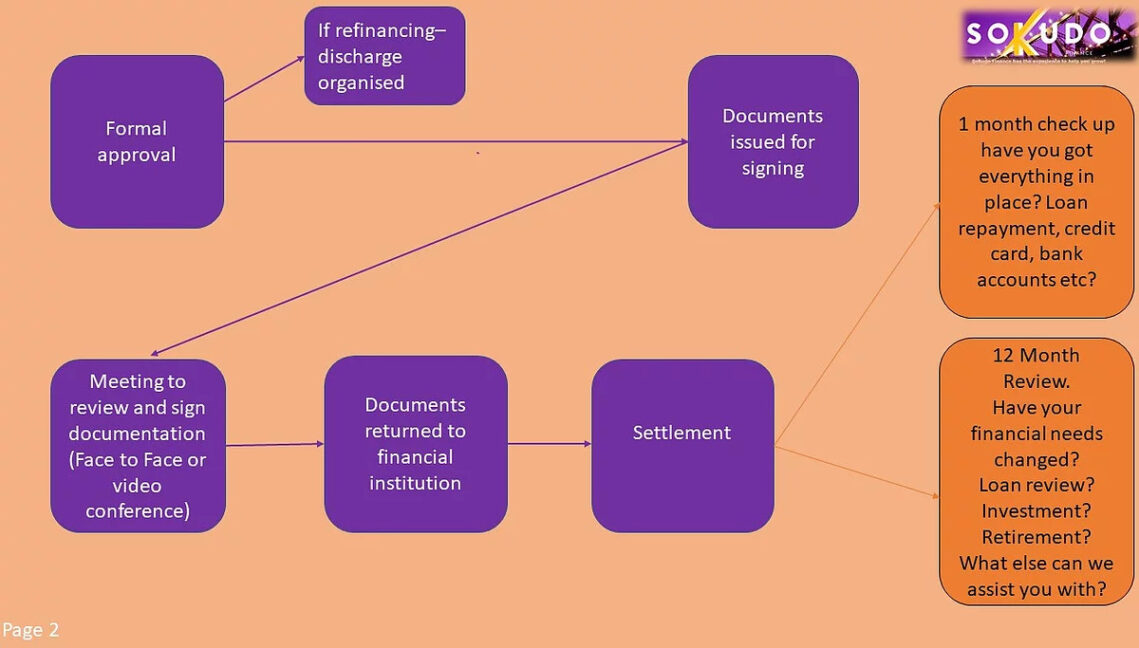

As a customer, a couple of questions you may find your self asking are:

- What comes next?

- What can you do to be prepared?

- How can I have the best customer experience possible?

We have all been in situations where not knowing creates a negative customer experience, the charts below assist in helping you understand what’s next!